Blogs

The new handling from Mode 8379 may be delay if the these models aren’t affixed, or if perhaps the design is incomplete when submitted. When you’re owed a refund but haven’t paid off certain numbers you owe, all the or section of their refund may be used to pay the otherwise area of the previous-owed number. Including past-owed federal tax, other federal expenses (such as figuratively speaking), condition income tax, son and you will spousal service repayments, and you will state unemployment settlement debt. You might be informed if the reimburse you said might have been offset facing the money you owe. The fresh safest and you can proper way to get an income tax refund is to e-document and choose direct deposit, and therefore securely and you can electronically transmits your reimburse into debt membership.

Below content withholding, the newest payer of great interest must withhold, since the tax, for the count you are paid, by making use of the right withholding rates. Withholding becomes necessary on condition that there is an ailment to possess duplicate withholding, such failing to give the TIN on the payer or failing to approve your own TIN below punishment from perjury, if required. Part of an excellent kid’s 2024 unearned money could be taxed in the the brand new parent’s taxation price. If that’s the case, Setting 8615 should be completed and connected to the kid’s tax come back.

An excellent nine-shape income happens when the yearly money ahead of income tax are anyplace anywhere between $100 million bucks and you will under $step one billion dollars. This can not be totally earned as the an authentic income. Rather, it will are the value of other pros anyone receives, such commodity, endorsements plus increases in the value to their own investment profile. Redeem all of our private discount code USA31BONUSCODE and you will receive a great $29 totally free chip! The fresh earnings of playing so it bonus is cashable, which have a max cashout level of $180.

Online casinos favoritos de VegasSlotsOnline

Brand new players out of NZ score a good $step one put added bonus after sign up. After you subscribe Betting Pub via an https://happy-gambler.com/bertil-casino/ association on this web site you can buy more than 50 totally free spins for just $6. For the first proper money put (only $1) you currently obtain the first 31 totally free revolves. In order to get fifty totally free spins from the Playing Bar your need add some other $5 deposit. Betting Club adds one hundred free spins for your requirements when you find yourself one second deposit. This means it’s possible to cash-out a real income just after to play with your 31 incentive revolves.

How do i Prepare My personal Come back?

Although not, simply their parent is get rid of Reid because the a qualifying man. The reason being your own mother’s AGI, $15,100000, is over your AGI, $9,300. To decide which people is eliminate the child because the a great being qualified son to help you claim this type of four taxation benefits, another tiebreaker laws use. For reason for these tiebreaker regulations, the term “parent” form a biological or adoptive father or mother of individuals. It doesn’t were a stepparent or foster father or mother unless see your face has implemented the individual. An excellent foster-child resided with a wedded couple, the brand new Smiths, going back ninety days of the year.

€/£/$step 1 Lowest Deposit Gambling enterprises

The 23-year-old sibling, that is students and single, lifestyle along with you as well as your partner, just who render over fifty percent of one’s cousin’s assistance. Both you and your spouse is twenty-one, and also you document a joint go back. The sis actually their being qualified kid since your sis is not young than your or your spouse.

Worksheet 5-1. Figuring the expense of Class-Life insurance To incorporate in Income—Represented

Another a couple of tests have to be came across for you to subtract one taxation. These are taxes enforced by the a different country or some of their political subdivisions. If your eyes position isn’t really going to increase beyond these types of constraints, the new report includes this reality. One is thought to arrive at ages 65 at the time before its 65th birthday celebration. For more detailed information to the Roth IRAs, find section 2 from Bar. A good rollover away from a specified Roth account can only be made to a different appointed Roth membership or perhaps to a good Roth IRA.

A required costs is certainly one that’s helpful and you can right for your online business. A cost doesn’t have to be required to qualify required. An expense isn’t really thought luxurious or extravagant if it’s sensible in accordance with the items and you will issues.

For more information, see Options Areas Faq’s from the Irs.gov/Newsroom/Opportunity-Zones-Frequently-Asked-Questions. If you were given a prize within the recognition away from successes within the religious, charitable, scientific, visual, academic, literary, otherwise civic areas, you should basically include the value of the fresh prize in your money. However, you wear’t tend to be it prize in your earnings if you fulfill all of your own pursuing the standards. For individuals who win a prize inside the a lucky matter drawing, tv or broadcast quiz system, charm competition, or other feel, you need to is they in your income. Such, for individuals who victory a great $50 honor inside the a photographer event, you need to statement so it earnings on the Plan step one (Mode 1040), line 8i. If you don’t accept a reward, don’t is the worth on your money.

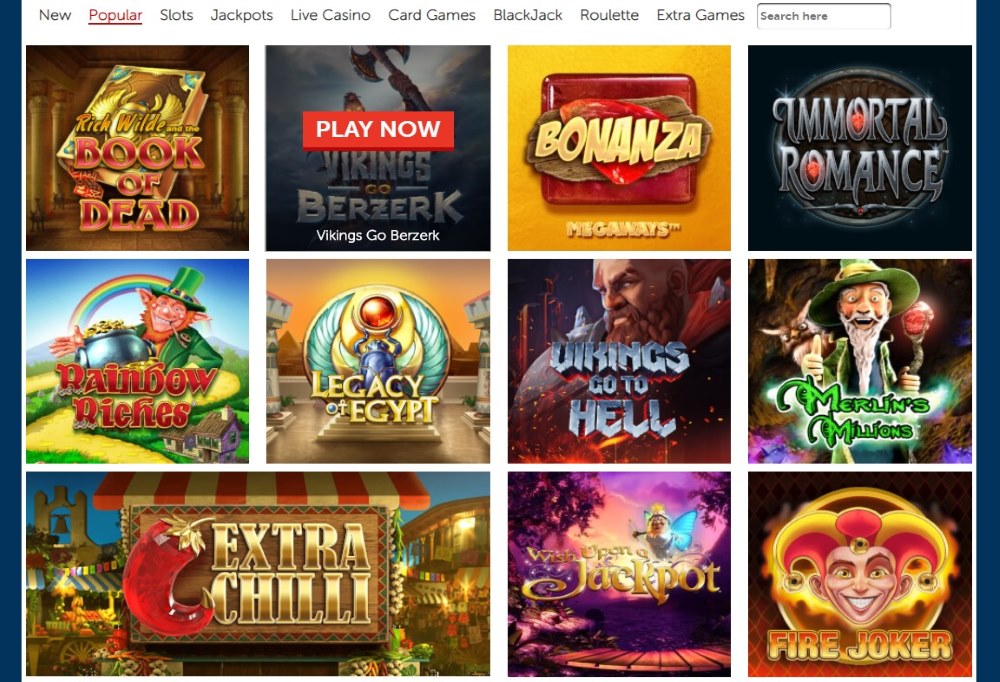

Video game variety & software team

Most other money issues briefly mentioned below are referenced to books and that give a lot more relevant guidance. Costs made by your state to help you certified people to remove the cost of winter months opportunity explore aren’t taxable. The brand new income tax treatment of unemployment pros you get relies on the new form of program paying the pros. NIL are a phrase one to identifies the new mode by which scholar-sports athletes can discovered financial payment.